When Stock Markets and Currency Values Dance: What BRICS Nations Tell Us About Money

How do BRICS stocks move currencies? This 40-year study reveals how market extremes impact global investments, offering vital risk-management insights for investors and policymakers.

Have you ever noticed how when your country’s stock market soars, the value of your currency might shift? Or wondered why financial experts constantly watch both stock prices and exchange rates? A fascinating new study from India, examining five major emerging economies reveals that these two financial forces are more intimately connected than most of us realize—and understanding this relationship could change how we think about international investing and economic policy.

The Big Question: Are Stocks and Currency Connected?

Imagine you’re holding two remote controls, one for your country’s stock market and one for your currency’s value against the dollar. The central question researchers asked is simple but profound: when you press a button on one remote, what happens to the other?

This isn’t just an academic exercise. The answer affects everyone from government policymakers deciding on economic strategies to everyday investors planning their retirement portfolios. The research focused on the five founders countries of the BRICS group—Brazil, Russia, India, China, and South Africa—representing some of the world’s largest emerging economies with combined populations exceeding three billion people.

These nations offer a perfect laboratory for studying this relationship because they’ve experienced everything from financial crises to pandemic shocks, giving researchers nearly four decades of data from September 1985 through December 2024.

Two Competing Theories: Which One Wins?

Economists have long debated how stock markets and currency values influence each other, proposing two competing explanations that point in opposite directions.

The first theory, called the “flow-oriented model,” suggests they move together. Picture this: when a country’s currency loses value, its exports become cheaper to foreign buyers, like having a clearance sale that attracts international customers. Companies sell more products abroad, profits increase, and their stock prices rise. It’s a positive relationship—currency down, stocks up.

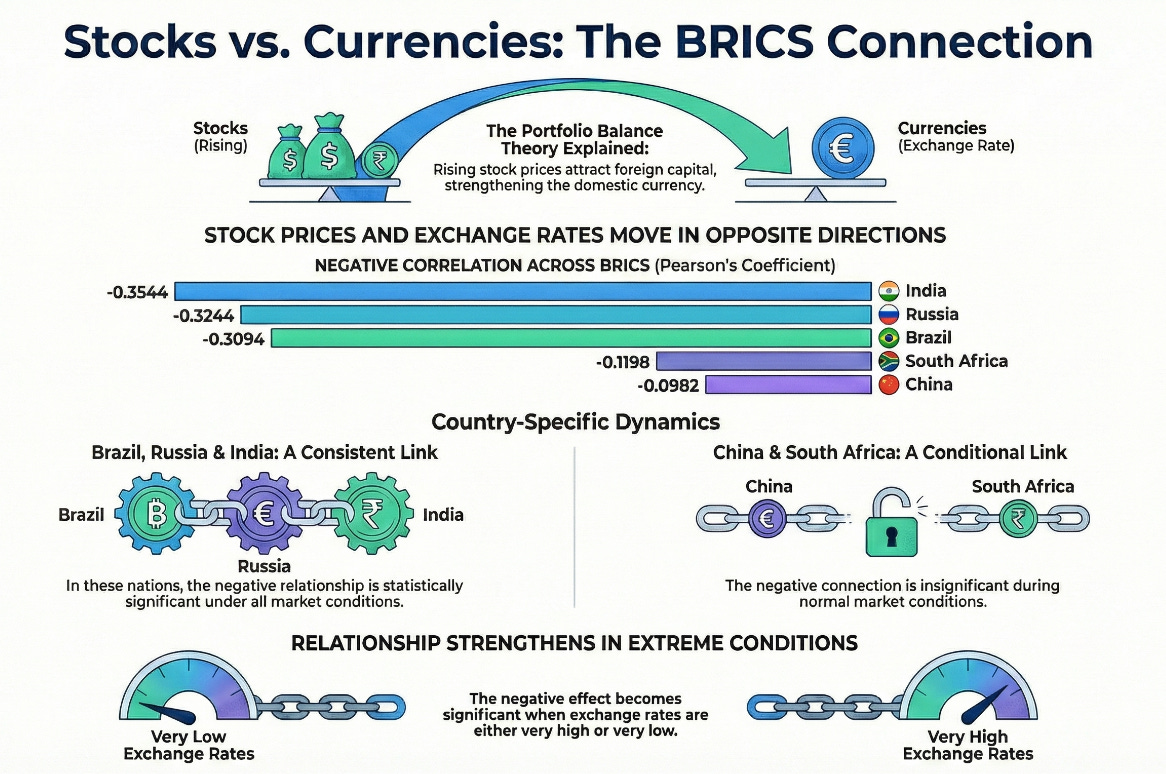

The second theory, known as the “portfolio balance approach,” predicts the opposite. Think of it like a seesaw: when domestic stock prices climb, foreign investors rush to buy these attractive assets. But to purchase Indian stocks, for example, you first need Indian rupees. This increased demand for the currency causes it to strengthen. So rising stock prices lead to a stronger currency—an inverse relationship.

Which theory is correct? The answer turns out to be more nuanced than a binary choice.

The Missing Piece: Not All Market Conditions Are Equal

Previous research hit a wall because most studies used a statistical method that only looked at average relationships—like judging a movie by watching only the middle scenes. This approach missed crucial details about what happens during market extremes.

Think about the difference between a calm day at the beach and a hurricane. The relationship between wind and waves changes dramatically depending on conditions. Similarly, the connection between stocks and currency might behave differently when markets are crashing versus when they’re soaring.

The researchers employed a more sophisticated technique called “quantile regression”—essentially examining the relationship not just in normal times, but across the entire spectrum of market conditions, from extreme lows to extreme highs.

The Findings: A Pattern Emerges

The results paint a fascinating picture. For Brazil, Russia, and India, the relationship was remarkably consistent: stock market gains consistently predicted currency depreciation across nearly all market conditions. The portfolio balance approach wins decisively for these three nations.

Here’s what this means in practical terms: when Brazilian stocks rally, the Brazilian real tends to weaken against the dollar. This happens whether markets are in crisis mode or celebrating bull runs. The relationship remained negative and statistically significant at nearly every level the researchers examined.

For South Africa and China, the story was more complex. These countries showed the negative relationship primarily during extreme market conditions—either when currency values were unusually low or extraordinarily high. During more moderate conditions, the connection weakened or disappeared entirely.

Imagine a thermostat that only kicks in when your house gets really cold or really hot, but does nothing in comfortable temperatures. That’s how the stock-currency relationship behaves in South Africa and China.

Why Extremes Matter More Than Averages

One of the study’s most important revelations is that the relationship intensifies at the extremes. When exchange rates hit very low or very high levels, the negative correlation strengthens significantly.

For India, the researchers found the effect was particularly pronounced. Using the traditional averaging method, the relationship appeared moderately negative. But the quantile regression revealed that during extreme market turbulence—the financial equivalent of Category 5 hurricanes—the negative relationship became substantially stronger.

This discovery carries serious implications. It suggests that during precisely the moments when investors and policymakers most need to understand market dynamics—during crises—the forces at play are most powerful and most different from normal times.

What This Means for Real People

You might wonder: why should someone not trading international currencies care about these findings? The answer touches multiple aspects of modern financial life.

For investors, this research offers a roadmap for managing risk. If you’re investing internationally, understanding that stock market gains in Brazil might coincide with a weaker real helps you anticipate and protect against currency losses. It’s like knowing that ice makes sidewalks slippery—you adjust your walking accordingly.

For policymakers, these findings suggest that central banks and government officials need different playbooks for different market conditions. A monetary policy perfect for calm markets might backfire during turbulent times when the stock-currency relationship intensifies. It’s the difference between steering a ship in calm waters versus navigating a storm.

The research also highlights something financial advisors have long preached: diversification matters, especially in emerging markets. The fact that China and South Africa behave differently from Brazil, Russia, and India under similar conditions means spreading investments across multiple countries provides real protection.

The Bigger Picture: Markets Are More Complex Than We Thought

Perhaps the study’s most profound contribution is demonstrating that financial markets are not uniform machines producing predictable outputs. They’re more like living organisms that respond differently depending on their environment and stress levels.

The traditional approach of looking only at average relationships—like judging an athlete solely by their typical performance—misses how they perform under pressure. This research shows that the extremes matter immensely, and they behave differently than the middle ground.

For the billions of people living in BRICS nations, these findings could influence everything from employment opportunities to the cost of imported goods. When domestic stock markets surge, the resulting currency depreciation might make foreign vacations more expensive but could boost export-driven jobs.

Looking Forward: What We Still Need to Learn

While this research answers important questions, it also opens new ones. The study examined the relationship between just two variables—stock prices and exchange rates—but real economies involve countless interconnected factors. Interest rates, oil prices, political stability, and technological changes all play roles.

Additionally, the world has changed dramatically since 2020. The COVID-19 pandemic, the rise of artificial intelligence in trading, and geopolitical tensions have transformed financial markets in ways still being understood. Future research will need to explore how these new forces reshape the stock-currency relationship.

The Takeaway: One Size Doesn’t Fit All

The clearest message from this research is that financial relationships aren’t universal or constant. They vary by country, by market condition, and by the extremity of the situation. The portfolio balance approach generally holds true—rising stocks tend to accompany weakening currencies—but the strength and consistency of this relationship depends entirely on context.

For those of us navigating an increasingly interconnected global economy, understanding these nuances isn’t just academic. It’s practical knowledge that can inform better investment decisions, smarter policy making, and deeper comprehension of the financial forces shaping our world. The dance between stock markets and currency values continues, and now we understand its choreography a little better.

Join the Conversation:

📌 Subscribe to Think BRICS for weekly geopolitical video analysis beyond Western narratives.

Averages comfort; extremes educate.