Trump’s Tariffs: Economic Strategy or Global Risk? How New U.S. Trade Policies Could Reshape the World Economy

Trump's Tariffs: Protectionism or Peril? Explore how U.S. trade policies risk global economic stability while creating opportunities for BRICS nations to reshape world trade dynamics.

U.S. President Donald Trump has called tariffs—taxes on imported goods—"the best word in the world," even better than "love" or "respect" (Rushe, 2024). But his latest trade policies risk destabilizing the global economy. Protectionism uses tariffs as a shield for domestic producers against foreign competition.

In April 2025, Trump announced "Liberation Day" tariffs, imposing new taxes on allies (Canada, Mexico, EU) and rivals (China) for key imports like semiconductor chips, steel & aluminum, and Foreign cars & parts. He also debuted "reciprocal tariffs," which automatically match half of the U.S. trade deficit with any country that retaliates (Lawder, 2019). While supporters claim this will revive U.S. factories, critics warn it could backfire. Trump's disdain for trade deficits, when you buy more than sell, mirrors mainstream economists’ opinions on Protectionism.

Trump’s Economic Warfare Strategy: Why Tariffs Are His Weapon of Choice

President Trump’s aggressive tariff policies are not just about trade—they’re a form of economic warfare designed for geopolitical coercion and to force concessions from other nations. Unlike traditional military conflicts, this approach uses financial pressure to achieve geopolitical goals without firing a shot. Tariffs, however, disproportionately hurt low-income consumers by raising prices (Rushe, 2024). His tax cut, had the same effect, resulting in the top 400 families paying a lower effective tax than the bottom half of the population.

Why Trump Relies on Tariffs

Leverage Over Trade Partners

The U.S. runs trade deficits with most nations (meaning it imports more than it exports). By imposing tariffs, Trump forces exporting countries to either raise prices, which inevitably are passed down to consumers. An example is China’s 126% tariff forcing manufacturers to either lose money or abandon the U.S market.

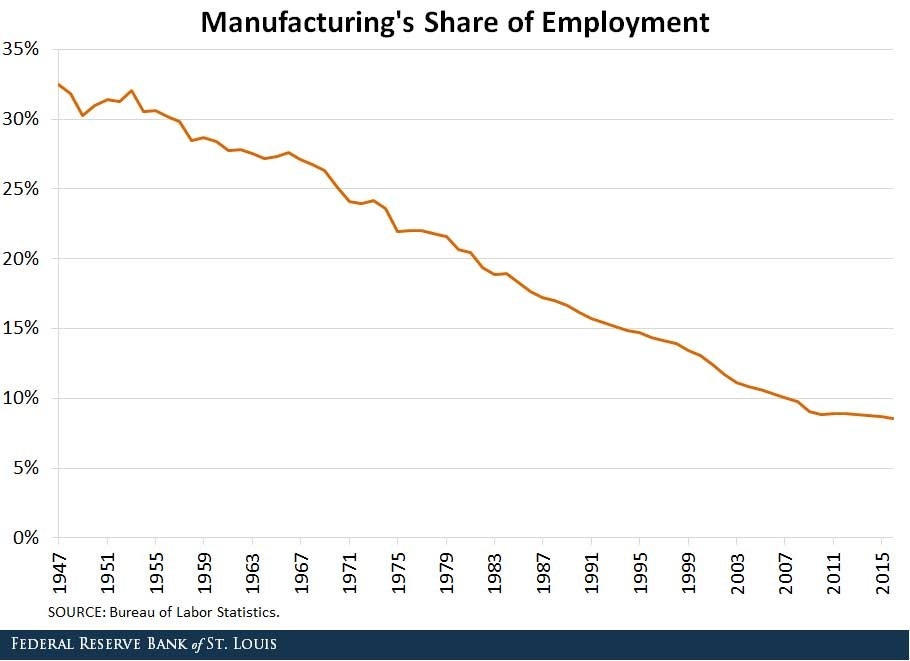

"America First" Industrial Policy

Trump argues America has been “ripped off” by their trading partners, so tariffs will reindustrialize the country with manufacturing jobs and protect "strategic" industries vital to national security, like steel and semiconductors.

Replacing Income Taxes with Tariffs?

Trump has floated the idea of abolishing income taxes and funding the government entirely through tariffs, a policy promoted by his idol William McKinley.

Economic Warfare in Action

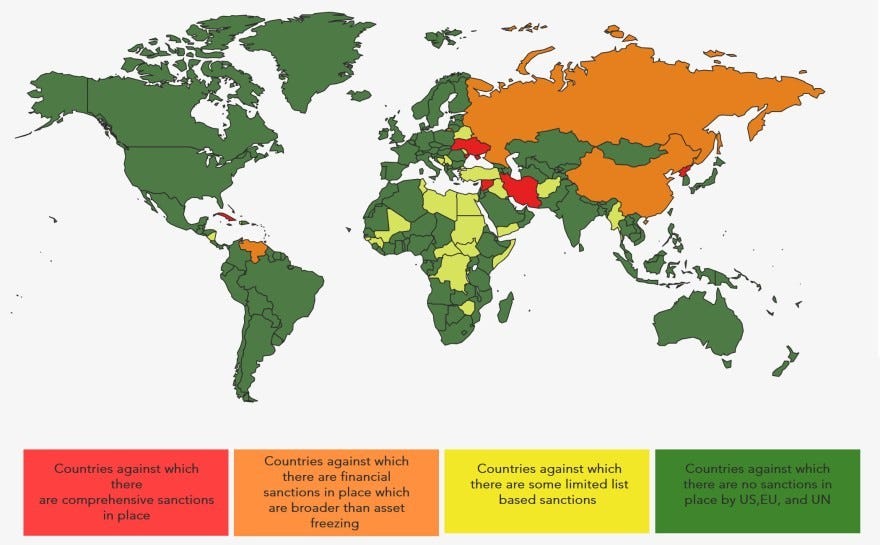

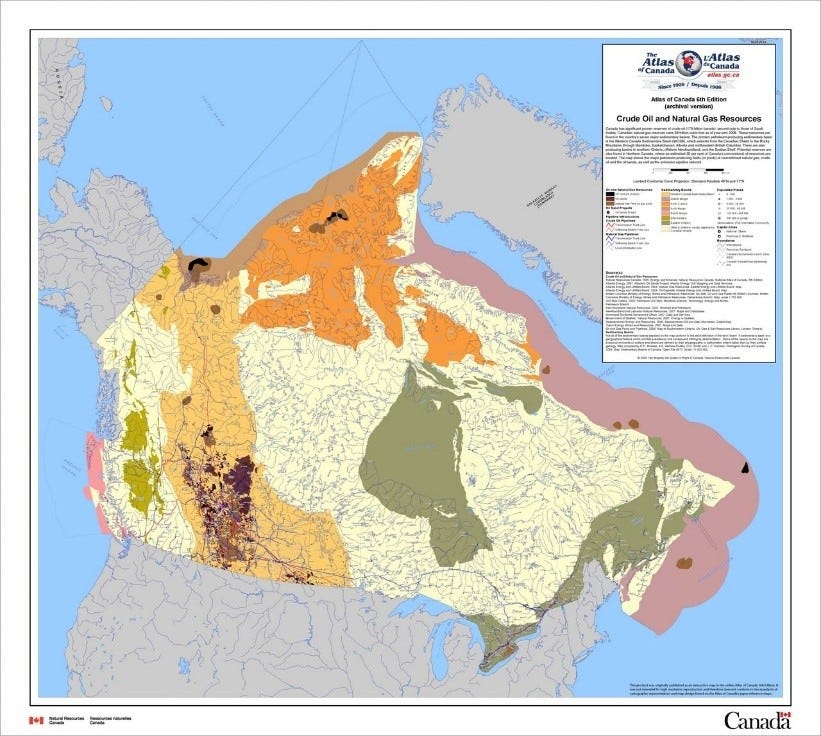

In addition to his long-running feud with China, President Trump has lashed out at his neighbors. He has threatened Mexico with 25% tariffs unless it militarizes its border to stop fentanyl trafficking as well as to Canada to share Arctic oil reserves or face auto sector tariffs. The U.S. has also banned China from receiving semiconductor chips, among other strategic metals and electronics, and boycotted their companies (e.g. Huawei, TikTok) to stifle its development.

Trump Taking a Gamble

His negotiation strategy will have dire effects on supply chain networks, the dollar’s strength, and consumers’ budgets. Tariffs on Chinese goods from Trump’s first term raised prices on electronics, clothing, and appliances by up to 15%. Moreover, nations like Russia and China, followed by over 80 countries, are diversifying away from the dollar in response, weakening U.S. financial dominance. Now with Trump’s uncertain nature, long-term planning for businesses will be increasingly difficult and impossible.

1. The Panama Canal: "We Built It, We Should Own It"

The canal is a strategic chokepoint, handling 6% of global maritime trade, including U.S. oil and LNG shipments. In 2018, Trump publicly questioned why the U.S. doesn’t regain control of the Panama Canal, calling its 1999 handover a "bad deal” and suggested tariffs on Panamanian goods unless the U.S. gained greater influence over canal operations.

Currently, Panama has expanded U.S. military access to canal-adjacent bases but was unable to sell it to BlackRock before canceled by Chinese authorities

2. Greenland & Ukraine: "A Real-Estate Deal with Strategic Minerals"

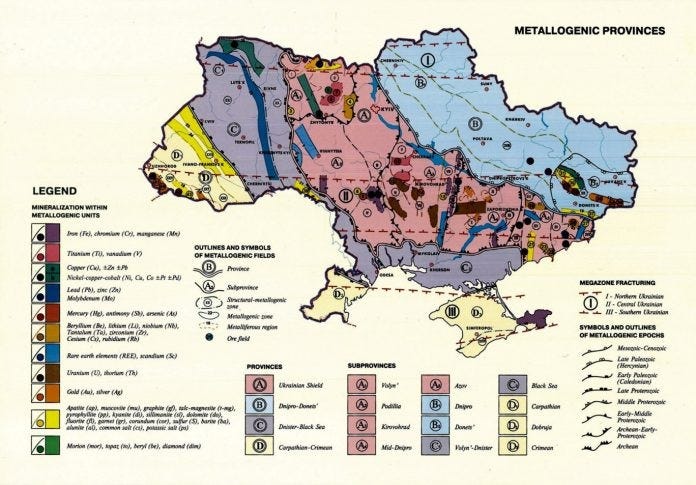

Trump has proposed buying Greenland from Denmark multiple times, for its vast reserves of rare-earth metals, such as Oil and uranium. After Denmark refused, Trump canceled a state visit and hinted at tariffs on Danish pharmaceuticals.

Similarly to the Panama Canal, Trump’s efforts to militarize the Arctic’s "last frontier," to halt the development of the Arctic Silk Trade Route.

For Ukraine, Trump offered private loans in exchange for control of fertile farmland, often touted as Europe’s breadbasket, and mining rights to lithium/cobalt (used in batteries).

Who Pays the Price?

Consumers & Businesses

Tariffs act like hidden sales taxes, so whether the increased costs is passed onto consumers depends on its elasticity. Inelastic goods, which are essentials like food, are easier for companies to pass on to buyers. Elastic goods, like designer bags, on the other hand, will show a steep drop in demand.

Investors & Markets

The NYSE plunged 10% after Trump’s announcement, then rebounded 7% days later—a sign of extreme uncertainty (Long, 2019).

Workers

Trump’s focus on Rust Belt states (former industrial hubs like Michigan and Ohio) resonates with blue-collar voters, even though his 2017 tax cuts favored the wealthy.

What Could Possibly Go Wrong?

As Private Debt continues to soar, many worry that this will backfire on the United States. U.S. household debt hit $17.5 trillion in 2024. Mainstream economies do not use money in their policy models, nor do they expect private debt to impact the likelihood of a recession. Economist Hyman Minsky warned that reckless debt leads to crises, an elevated risk if tariffs spike inflation.

Also, using the impossibility trinity, we can show his policy goals are contradictory. Essentially, a country cannot have a current account surplus, or fixed exchange rate, while maintaining the reserve currency. Considering he prefers the dollar to reign supreme, compared to an account surplus, so not only will his actions increase prices, but are not possible to begin with.

Global Fallout & BRICS Opportunity

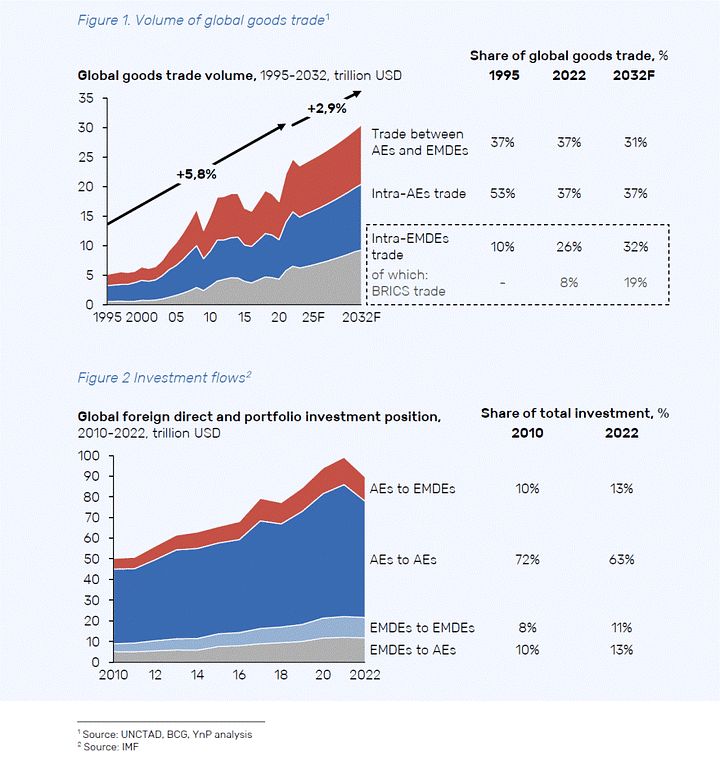

President Donald Trump's tariffs have not only weakened his own economy but also created an opportunity for the BRICS Institution to facilitate intra-member state trade and promote supplier diversity. Trump overestimated his leverage for several reasons. Now that BRICS+ nations have surpassed the G7 countries in economic growth and output, they can diversify suppliers amongst themselves.

Countries around the world are increasingly diversifying their foreign-exchange reserves away from the U.S. dollar. Russia and China have already eliminated over 90% of dollar use in their bilateral trade, with 80 additional nations now following suit. Unlike the founding BRICS members, however, countries such as Mexico and Canada have less negotiating power—making their economic relationships a telling case study in responding to Trump’s tariffs.

The BRICS bloc actively promotes supplier diversity through initiatives like the 2023 BRICS Trade Fair, where over 500 companies exhibited goods ranging from Russian fertilizers and Indian pharmaceuticals to UAE logistics services. The event facilitated $3 billion in signed deals, including Brazilian agribusinesses supplying soy to China.

Conclusion: All-In On the Dollar?

Has globalization finally died, or is it shifting under Trump's "America First" agenda? While his tariffs aim to strengthen the U.S. economy, they risk accelerating the rise of a multipolar world, where BRICS nations forge regional trade networks and challenge U.S.-dominated systems. Though framed as pro-workers, critics warn these policies inflate consumer costs and favor corporate interests. Will history ultimately judge if Trump's tariffs are the catalyst for reviving domestic industries? Or deepen inequality to the point of catastrophe?

You ask ‘Has globalization died?’ Under the BRIX (BRICS+) mosaic model that you talked about earlier this week, I think that globalization as a uni-party top-down organization has died. Globalization as a grassroots independent consortium just went into acceleration mode thanks to the huge inconsistencies with the Trump administration. When you throw sand in the sandbox, the other kids go play elsewhere.

It appears that Trump is dismantling at rapid speed the WW2 matrix. This leaves an opening for BRIX and the SCO. Three of four partners in the mBridge system are Asian banks. I would like to see a more balanced financial approach such as adding the Bank of India or another partner. Is the UAE representing the entire Middle East? I perceive that Africa’s days in the sun are coming.

The BRIX model is more akin to a confederation, a group of independent structures working together on common projects. This is similar to the America model where the states work together, but without the federal overstructure. There are similarities. I could be off-base but BRIX appears to be authoritarian structures working in a democratic organization with significant collaboration vectors.

One can be both pro-America and pro-BRIX because it is pro-evolution. I ponder if nation states tied in uber overstructures like the EU can exist now, the overstructures seem both expensive and inflexible. The world governments are vibrating, and when they hit their resonant frequencies, overstructures can be cast off. The Trump administration just increased both the frequency and amplitude of the vibration. We do live in interesting times.

Reading Von Hoffmeister .:. Does the mosaic of multipolarty require that no one national currency is the reserve currency? Will all curriencies be measured against gold (the other Tier 1 asset)? I am thinking that the global benchmark would be a commodity (Basel 3-4) but it could be multiple commodities.